...like "quantitative easing."

See, I just wrote that, and already you want to click onto something else. War. Funny pets. The abortion debate. Nothing is more boring by design than economics, because this is the pseudoscience that is used to induce a kind of mass intellectual anesthesia. Like many of the experts to whom we turn over our lives in the age of bureaucratic individualism, economists' competence is their power is their competence. Their expertise in in convincing you that they know what they are talking about, and they talk about what they talk about in language that is intentionally arcane so you can mimic it, if you haven't gone to sleep yet, without every understanding what is really going on.

Church folks like us, we ought to know about this, because things are going to happen that challenge us personally and as church.

But I said above that the boring stuff can getcha. And we are going to get got yet again, and it is as sure a thing as you can count on. There is a mutant beast just outside the campfire.

The repetitious rumors of economic recovery are all lies. There is no recovery. The powers are making things worse; and the means they are using to conceal reality are ensuring that when the fired goes out, the mutant beast will be bigger and meaner than ever.

Matt Taibbi wrote about one particularly egregious example of this in Rolling Stone yesterday, which is informative even though he has a very macho and off-putting style of sexist language, generalized put-downs, and the personalization of outrage, that he seems to think makes him very gonzo and edgy. Here is the article, which I recommend because of its information density and particularization of the problem about which I will be a good deal more general.

Remember in 2007-8, when the financial sector collapsed, and the economists told us they were too big to fail, and we picked up the tab to bail our Wall Street, because - we were told - if we didn't bail out the bond traders, the sky would fall? Ever since, we have been bailing and bailing, and we bump along, waiting for the recovery, that "the numbers" tell us is almost there, but the reality for us and almost everyone we know has stayed the insecure same or gotten worse. You've heard it. Obama is saving the economy, because... look at the stock market numbers, the new jobs.

I have bad news. Higher stock market numbers does not translate into a better economy. There is not reduced real unemployment. The new jobs are shit jobs, exchanged for the decent jobs that have gone away for good.

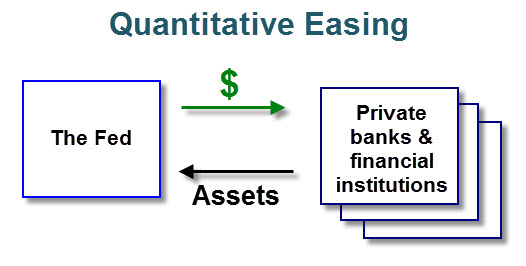

Let's talk about the stock market, and about that weird term, "quantitative easing." We need to get out heads around something first, though.

Think about the term "capital." Most of us mean some money to invest. I'd like to run a mobile hot dog stand or open a bicycle repair shop, and I need some capital. Which is part of the story. One kind of capital is that. We can call that material investment capital. You get a loan, buy and rent the things you need to produce a good or service; then as you get up and running, you pay back the loan out of the proceeds, and eventually, you pay the debt and the investment pays for itself from then on. Banks that made these kinds of loans - many of them used to be local banks, or even credit unions - are called "commercial banks."

There is, however, another kind of capital. This is when you take out a loan and you invest it in stocks, bonds, derivatives, or currency markets, and you hope the fluctuating values of your purchases fluctuate up instead of down, then you cash out if they go up. You can call this gambling, which it is, but economists call this "speculative" capital to differentiate it from material investment capital. These two kinds of capital influence one another, so much so that the speculative capital can grow so much bigger than the investment capital that - if the prices of speculative assets suddenly falls - the material economy can get pulled into the crapper with it. Institutions that made loans for this kind of gambling were called "investment banks" or "investment institutions." Tricky, that language.

This is what happened in 1929, which kicked off the Great Depression, so under the New Deal, the government put a firewall between commercial banks and speculative "investment" outfits. It was called the Glass-Steagall Act, and it said that commercial banks - like the kind that make loans for your bicycle repair business, or which hold your checking and savings accounts - were not permitted to engage in speculative activities with non-governmental agencies that investing in "securities," a clever and misleading term for stocks and bonds and other, more bizarre and modern gambling instruments (see Taibbi's article, or, if you really want a trip through the looking glass, look up derivatives). Savings bonds and treasury bills were fine, because these were guaranteed by the government.

There were loopholes, of course, and over several decades, the financial speculators wormed their way back into banking, and the Clinton administration put the final nail in the coffin by repealing the Glass-Steagall Act altogether. Since then, we have had three "speculative shocks": the dot-com bubble, the Asian financial crisis, and the housing bubble that exploded in 2007-8.

Republicans and Democrats are equally responsible, because this is how present-day American capitalism works; and both are committed to it. If you want to know the real deal about money and power in the US, pay attention to the stuff that has bipartisan support. Another good example of that is the list of "free trade" agreements that never have any opposition. These, also, by the way, benefit Wall Street. (For an in-depth look at something called the "Dollar-Wall Street Regime," check out either Peter Gowan or Susan Strange.)

Here is what the problem is. Money is printed in response to credit. Credit can be extended for material investment or for speculation (gambling). The idea of material investment is that material values will be created which will pay the credit back; but the value created by speculative frenzies is not connected to the material economy. This can cause a growing pool of what we might call "fictional" value.

Once, in the seventeenth century Dutch Republic, there was a craze for tulips that turned them into an investment frenzy. The price kept going up and up, and people watched this price inflation, and the urge to get in on it became irresistible, further driving up the prices, until a single tulip bulb cost ten times an annual wage. Then someone said that this emperor had no clothes, and the price crashed, and a lot of people had some very bad days. That was "fictional" value.

The Dow jumping over the fourteen stick the other day... that is fictional value. And you are subsidizing this, which I will explain further along. It is the same kind of fictional value that set up 1929. It is the same kind of fictional value that created the dot-com bubble. It is the same kind of fictional value that created the housing bubble - which became a vehicle for all kinds of other fictional values to be bundled with housing loans (again, see Taibbi's piece). Not only were housing mortgages mixed in with crap-bonds and other worthless paper, insurance companies and pension plans were heavily invested.

The government has an insurance plan that prevents banks from closing their doors and letting you lose your savings, which is what happened in 1929. It is called the Federal Deposit Insurance Corporation. This means the government (that is you, in terms of who pays) is on the hook if the banks go under. And since we started letting regular banks engage in gambling again, we are on the hook for gambling debts when the banks lose. Losing here means basically that one of these fictional value bubbles explodes.

So after 2007-8, when the banks lost their asses (not to put too fine a point on it) because they were so mixed up with powerful and reckless speculators, the government had several choices. They could have nationalized the banks and re-erected the firewall, bailing out regular bank customers like you and me. They could have allowed the Wall Street institutions to fail, and implemented emergency Keynesian measures like public works jobs programs, bailouts for pension funds, and debt forgiveness for key debtors to Wall Street and underwater mortgages. Or they could pump money back into Wall Street to reflate the bubble.

The latter option was taken.

Sure, they gave the speculator-bankers a stern lecture, saying you ought to use this money we are loaning you at near zero interest to open the credit faucets and stimulate more production and consumption... which is problematic in the long term for us and the environment, but for the time being, we are all hooked into this so-called "growth" paradigm. Wall Street ignored the stern warning, since they finance campaigns on both side of the aisle and they know who is the bread and who is the butter.

The speculators, who were also running the Federal Reserve and serving as key economic advisers to every President since Reagan, were rewarded for torpedoing the economy. Everyone heard about the original bailout, which was a mere $700 billion (that would only cost as much as six months of a double military occupation). This was called the... you're gonna love this... Troubled Asset Relief Program (TARP). "Troubled assets" surely ranks with "enhanced interrogation" and "collateral damage" for Orwellian Bullshit of the Century (OBC) awards. But TARP is nothing compared to what came afterward with far less fanfare.

Get ready for "quantitative easing" (QE).

Not only did speculators not use their money gifts from the US Treasury to open the credit faucets to Main Street, they went straight back to the casino. How was this money handed over? Well, I'm glad you asked that question.

QE is when the government buys the the most "troubled assets" (read, financial junk) that threatens financial institutions' bottom lines, thereby taking them out of the marketplace where their actual value would eventually be discovered, whereupon everyone would realize that they own tulips that cost as much as their house. So far, the Federal Reserve (that's our central national bank) has spent around $4 1/2 trillion to buy and hold financial junk, effectively transferring the eventual loss to us and taking it off the hands of private financial institutions. Trillion. A trillion is a thousand billion, which is a thousand million, which is a thousand thousand. And you thought 700,000,000,000 was a lot.

But wait, there's more. Not only are we buying busted AMC Pacers for $100,000 apiece (this is a conservative analogy), we are giving low-interest loans to the same people who are selling us the Pacers. By low interest, I mean between one-tenth and one-quarter of a percent. See if your bank will put that rate on your mortgage. Ya wanna know that these loans that you and I are making to these institutions are called. It'll crack you up.

"Special auctions."

No one outside of the Federal Reserve knows exactly how much has been loaned, but a reasonable estimate is around $10 trillion. That "T"" again.

Would you like to know what these financial institutions are doing with those loans? It's a rhetorical question at this point. You already know. They are gambling.

This trick for reflating a fictional value bubble is so effective at delaying the inevitable that Japan, the United Kingdom, and the European Union are all using their central banks to do the same thing, ensuring that the inevitable catastrophe will be shared by many.

This is your economic recovery. This is your economic recovery on really good drugs. Read more details here.

Last year, when the Federal Reserve threatened to "taper" QE back from its mere $85 billion a month (that's not a typo), the stock market started doing a pogo dance. This year, the Fed promises it will quit financing the bacchanalia, and already, the world's speculators are nervous.

It is always unclear how bubbles will burst, but it is inevitable that they will, or they will be reduced on the backs of the masses and not the financial sector. It may begin with a war on pensions. Who knows. But it is coming.

Right now, everything seems rosy, but the most recent blip-recovery is being fueled (pun intended) by a drop in the price of gasoline, which is a passing phenomenon, a windfall from a geopolitical game in which the Saudis have flooded the market with sweet oil as part of a strategy directed against Iran and Russia. Do not fooled.

The Second Great Depression is a mathematical certainty. We just don't know the date yet.

Get ready. Churches?

"Matt Taibbi wrote about one particularly egregious example of this in Rolling Stone yesterday, "

ReplyDeleteWas this an older essay you had written? Even if it is, your observations hold up well as usual.

Thanks,

Aaron