[A] Hillary Clinton coronation would mean a Democratic nominee with close ties to Wall Street and the neoliberal wing of the party. . ."

-Noam Scheiber

Neoliberalism – A Short History

The notion that a great expansion of the size of ‘capital markets’ is a symptom of positive trends in capitalist production is as false as imagining that a vast expansion of the insurance industry is a sign that the world is becoming a safer place.

-Peter GowanIn the Beginning…

Even in its embryonic form as far back as Nixon, neoliberalism has been formed by crisis. Michael Hudson’s book, Super Imperialism: The Origins and Fundamentals of U.S. World Dominance, described by its author as a book on financial history, is a fine and detailed account of this process, which we will necessarily abbreviate here.

After World War II, US economic production rose exponentially; and by the early 70s had run headlong into a general crisis of overproduction, or “over-capacity,” exacerbated by US spending on the war in Vietnam. Overproduction is when competitive pressure outruns demand and creates an overshoot of goods, that then accumulate dust in warehouses.

In addition to this crisis, structural contradictions in the ever-more-international economy received a catalytic shock in 1973 with an OPEC oil embargo.

The Nixon administration responded to the encroaching crisis by dropping the gold-standard, to which all currency was pegged via the dollar, then dropping the fixed currency exchange rates developed during the New Deal to prevent market volatility. This freed him for a strategic devaluation of the dollar that effectively wiped out purchasing power owed as debt to creditors abroad. Nixon effectively exported the crisis-restructuring burden onto its own creditors.

The burden was shifted off of the US state and US financial institutions, not off the US people. The US population suffered unemployment and stagflation. From the 70s through the early 80s, business cycles became unpredictable, industrial production dropped, and unemployment grew, lighting a fire under the Reagan administration to seize its first opportunity to restructure its way out.

Reagan was able to do just that, because the stage had been set by President Richard Milhouse Nixon.

The Nixon Hat Trick

Hey Rocky, wanna see me pull a rabbit out of a hat?

-Bullwinkle the MoosePresident Nixon inherited an international system of finance that was constitutionally based on a monetary agreement from the Bretton Woods conference during World War II. That agreement was that the dollar would be backed by gold – that gold to be valued at US$32 a Troy ounce – and that all other currencies around the world would exchange with that dollar at a fixed exchange rate. If there were ten pesos to the dollar, then there were always ten pesos to the dollar. No fluctuations, except by a deliberative process of revaluation. So Nixon released other currencies to float in a hostile sea. And he quit backing dollars with gold. Creditors couldn’t get gold anymore. They had to take more fiat dollars, or nothing.

The fixed exchange and gold standard prevented speculation in currency markets, which the Keynesians believed – rightly, as it turned out – opens the door to dangerous, unpredictable and even international destabilizations.

Nixon took stock of his situation, looked at what he owed in external debt, and factored in that the now hegemonic dollar is uniquely immunized in a speculative currency market. So he unilaterally abrogated the whole system, daring not his enemies but his allies to retaliate… but all of them had invested in the dollar themselves, alas, and they were forced to accept Nixon’s terms.

This created what some now call the Treasury-bond system of international finance.

What is a Treasury Bond?

[After WWII] it fell to the American state to take responsibility for making international capitalism viable again after 1945, with the fixed exchange rate for its dollar established at Bretton Woods providing the sole global currency intermediary for gold. When it proved by the 1960s that those who held US dollar would have to suffer a devaluation of their funds through inflation, the fiction of a continuing gold standard was abandoned. The world’s financial system was now explicitly based on the dollar as American-made ‘fiat money’, backed by an iron clad guarantee against default of US Treasury bonds which were now treated as ‘good as gold’. Today’s global financial order has been founded on this; and this is why US Treasury bonds are the fundamental basis from which calculations of value of all forms of financial instruments begin.-Leo Panitch

A Treasury Bond is a note from the US Treasury that says you loaned the United States some money, and that you can redeem the mature bond’s value plus a royalty, i.e., interest. You don’t have to redeem it at maturity. You can hold onto it, and the US will pay you back whenever you like. If you have $10,000 in bonds, then x-years from now you can cash it for your ten-grand-plus.

Let’s say then, you are very heavily invested in these instruments, when you come to realize that your debtor has taken so many loans, from so many people, that the loans are impossible to pay back. And any attempt to sell off the bonds could trigger a drastic devaluation. That is precisely the situation the world finds itself in now. Many nations hold T-Bills, and all know that if asked to redeem them the United States Treasury does not have the funds to pay back these loans and their interest.

As the saying goes, “If you owe the bank a thousand dollars, you have a problem; if you owe the bank a million dollars, the bank has the problem.”

The T-Bill system worked. No one dares demand repayment of US debt for fear they will instigate a dramatic devaluation of the dollar that would wipe out their own central bank reserves.

After Nixon’s gamble, all that was needed was the consolidation of a public-private partnership to oversee the newly emerging system. Wall Street went through the breach.

[T]he US government could, alone among governments, move the exchange price of the dollar against other currencies by huge amounts without suffering the economic consequences that would face other states which attempted to do the same.

And … the Nixon administration decided to try to ensure that international financial relations should be taken out of the control of state Central Banks and should be increasingly centered upon private financial operators. It sought to achieve this goal through exploiting US control over international oil supplies. It is still widely believed that the sharp and steep increase in oil prices in 1973 was carried out by the Gulf states as part of an anti-Israel and anti-US policy connected to the Yom Kippur war. Yet as we now know, the oil price rises were the result of US influence on the oil states and they were arranged in part as an exercise in economic statecraft directed against America’s ‘allies’ in Western Europe and Japan. And another dimension of the Nixon administration’s policy on oil price rises was to give a new role, through them, to the US private banks in international financial relations.

-Gowan, The Global Gamble, p 14

Gowan concludes, “Nixon gave Washington more leverage than ever at a time when American relative economic weight in the capitalist world had substantially declined and at a time when the productive systems of the advanced capitalist economies were entering a long period of stagnation.” Nixon learned how to “break out of a set of institutionalized arrangements which limited US dominance in international monetary politics in order to establish a new regime which would give it monocratic power over international monetary affairs” (Gowan 1999: 19).

He turned his greatest weakness into his greatest strength.

Nixon had calculated that dollar hegemony as a global system was “too big to fail” for the rest of the world, and the rest of the world backed down. We had now entered the stage of debtor-imperialism. The world’s biggest debtor is the world’s leader.

Richard Nixon pulled a rabbit out of the hat.

‘The Bankers’ Dilemma’ or, ‘How much is a trillion?’

If you owe the bank a thousand dollars, you have a problem; if you owe the bank a million dollars, the bank has the problem. In Treasury bonds alone, the US now owes foreign banks $3.7505 trillion. With a T.

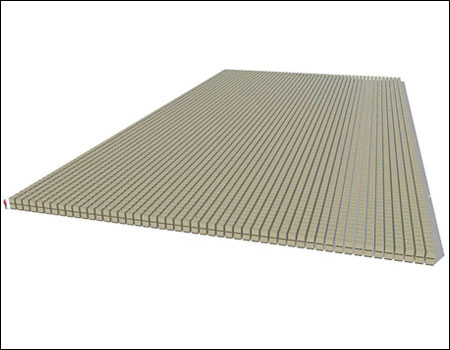

$10,000 in $100 bills is one-half inch thick. One million dollars in hundreds fits in a grocery sack. One billion requires a double-stacked forklift pallet. One trillion requires 1,000 double stacked forklift pallets. Or as David Schwartz explains:

One million seconds comes out to be about 11½ days. A billion seconds is 32 years. And a trillion seconds is 32,000 years. I like to say that I have a pretty good idea what I’ll be doing a million seconds from now, no idea what I’ll be doing a billion seconds from now, and an excellent idea of what I’ll be doing a trillion seconds from now.

(The little person on the left gives you scale. This is the $100′s stacked to a trillion.)

Foreign banks have a big problem. What can they say? Pay us back, or else? Or else what?

This abandonment of gold and fixed exchange rates opened the way for the elimination of New Deal restrictions on financial speculators. Nixon followed up with a series of strategic devaluations of the dollar that wiped billions of dollars of US foreign debt off the books in Germany and Japan, both of whom had to sit by and fume helplessly.

Political scientist Eric Helleiner noted that “…the basis of American hegemony was being shifted from one of direct power over other states to a more market-based or ‘structural’ form of power.” The structure was tidily summed up by economist Henry C. K. Liu: “The United States makes dollars. The rest of the world has to make things to get dollars.” Liu called this “dollar hegemony.”

Without fixed exchange rates, the non-dominant currencies are vulnerable to speculative attacks. To defend themselves, other countries’ central banks must hold dollar assets in reserve (to buy their own currencies if they are being sold down by speculators). These “reserves” are largely US Treasury bonds, loans to the United States.

If the People’s Republic of China holds $877.5 billion in US debt (which it does), and if the US dollar is devalued by 50% in a run on the currency, China can lose more than $438 billion. So the idea – promoted by some alarmists – that China can wreck the US economy by starting a sell-off on dollars is technically possible, but suicidal for China. Not only would it lose the purchasing power in its reserve, it would wipe out its biggest export customer, to which (exporting) the whole Chinese economy has been bent.

Other currencies, however, are more vulnerable to speculative runs, and this is exactly what happened.

The Financial Full-Nelson

Nixon’s legacy empowered Ronald Reagan a decade later to build the monetary system on a foundation laid with the coup against the Allende government in Chile in 1973, after which General Pinochet enthusiastically implemented economic restructuring in accordance with Washington’s wishes. One could say that Latin America was the lab where neoliberalism was tested.

The debt-leverage system set the stage for taking advantage of crises generated by currency speculation. When foreign currencies crash in the metastasized speculative market (and they can be crashed intentionally as they were in Asia in the 90s), nations are thrown into a maelstrom of instability – including hunger, the most volatile phenomenon of all. The lifeline to these nations’ government’s are massive loans in US dollars.

Lenders do not lend out of altruism. There is a payback plan (and it’s called “structural adjustment”).

The Dollar-Wall Street nexus can manipulate these emergencies to penetrate markets throughout the world, using the IMF as a lever with its conditional emergency loans. This “technique” was pioneered by the Reagan administration in response to the Mexican currency crisis of 1982.

Wikipedia:

The Latin American debt crisis was a financial crisis that occurred in the early 1980s (and for some countries starting in the 1970s), often known as the “lost decade”, when Latin American countries reached a point where their foreign debt exceeded their earning power and they were not able to repay it.

August 1982, the Mexican government announced that it was unable to pay its external debt to private US financial institutions. During the renegotiation of payments, the US-dominated International Monetary Fund (IMF) granted rescue loans on the condition that Mexico’s domestic economy (and the other Latin American nations swept into the current) be opened up (“liberalized”) to foreign (read: US) investment (read: takeover). All for a debt taken to cover another debt to the same institutions. In day-to-day life, this is called loan-sharking.

These loans were a contingent solution, principally to ensure Wall Street was made whole, but the Reagan administration and Wall Street had stumbled into a new method of debt-leverage that took advantage of crisis in the periphery to drain additional value from foreign domestic economies into US businesses and financial institutions.

A condition of the loan is the payback plan, wherein local governments were responsible to force their own populations (and environments) to bear the burden for repaying the loans – higher, more regressive taxes, the elimination of social programs, and the suppression of unions and environmental regulations. These measures were named “structural adjustment programs” (SAP) by the IMF.

SAPs became the new norm.

Virtually all developing countries—particularly in Latin America and Africa, and increasingly in the transition countries of east and central Europe—have implemented or are in the process of acceding to SAPs.-Foreign Policy in Focus

These IMF SAPs are in effect a loan-sharking operation against almost 70 poor nations. IMF loans are denominated in US dollars, and have inexorably grown into larger and larger fractions of the national outlays of peripheral economies. This obligation – in the face of a crushing international economic sanction threat – to service burgeoning external debts using US dollars is precisely why these national economies are pressured to almost wholly export to the US – now the world consumer of last instance.

The Dollar-Wall Street Regime

Peter Gowan refers to the financial institutionalization of neoliberalism as the Dollar-Wall Street Regime.

[I]t is important to note how the two poles of this system — the Dollar and Wall Street — have re-enforced each other. First we can see how the new centrality of the dollar turned people towards Wall Street for finance. Because the dollar has been the dominant world currency, the great majority of states would want to hold the great bulk of their foreign currency reserves in dollars, placing them within the American financial system (or in London). Similarly, because many central commodities in the world economy were priced in and traded for dollars, those trading in such commodities would wish to raise their trade finance in New York and London.

-Gowan, p 19The dollar’s role was expanded across the world stage as something far more than currency, because it consumed the lion’s share of international financial markets. The sheer size of the US economy and consequent immunity of Wall Street meant that for any world actor investing a lot of dollars, Wall Street was the default.

In this way, the strength of Wall Street has re-enforced the dominance of the dollar as an international currency.

-Gowan, p 19

The Bipartisan Consensus

Through all the gyrations of American policies for the world economy, the DWSR has remained firmly in place, constantly reproducing itself. In 1995 the dollar still remained overwhelmingly the dominant world currency: it comprised 61.5% of all central bank foreign exchange reserves; it was the currency in which 76.8% of all international bank loans were denominated, in which 39.5% of all international bond issues were denominated, and 44.3% of all Eurocurrency deposits; the dollar also served as the invoicing currency for 47.6% of world trade and was one of the two currencies in 83% of all foreign exchange transactions. And if intra-European transactions were eliminated from these figures, the dollar’s dominance over all other transactions in the categories listed above becomes overwhelming.

-Gowan, p. 20Financial regimes require political regimes, and vice versa. Contrary to the IMF and World Bank hype about the rising tide that would lift everyone’s craft, the results in the peripheral nations were greater dependency, less self-determination, increased rural landlessness and urban poverty, and greater political repression.

Even today, in countries that are trying to gain self-determination, the structural web of neoliberalism continues to trap them. Subsistence and local agriculture are the keys to independence, but with dollar hegemony as a world system, agriculture has been transformed from subsistence and local production using smallholders, into far-flung monoculture plantations held by the rich, and worked by displaced peasants for wages. The product is for export, to get dollars for the international market, not for local consumption.

In Haiti’s Artibonnite Valley, there is capacity for growing enough rice to feed the whole country. Instead, it is exported for dollars, and subsidized US rice is sold to displaced Haitians who, living in the city, have no access to their own subsistence.

The surplus peasantry – moved off the land by various enclosures – has moved into the sprawling, dangerously constructed slums of the cities, where some can be employed in sweat shops, and the rest are part of the “informal” economy – resulting in structured antagonisms with the authorities.

Independence, in effect, would mean de-coupling from the dollar, which no one can do when debts and oil markets are denominated in dollars.

The US political establishment is as locked into this paradigm as everyone else, however. No non-neoliberal candidate for the Chief Executive slot can even get through the Primary phase, excluded as they are by the astronomical costs of campaigns and the willingness of the major economic actors to continue that price escalation. John McCain and Barack Obama and George Bush and John Kerry and Al Gore, all took money from Wall Street; and Wall Street always butters both parties’ bread in election years.

The US electoral system is one now thoroughly based on what Jamin Raskin and John Bonifaz termed “the wealth primary.”

SUMMARIZING NEOLIBERALISM

No national income statistics today measure the most important asset on which classical economics focused: unearned income and unearned wealth.

-Michael Hudson

.jpg)

Neoliberalism has been called “globalization.” That’s a little deceptive, because it suggests that the principle beneficiaries of the system are scattered across the world equally. The actual system is US-controlled, and directed more than any other single thing toward consolidating and expanding the power of the American state in the world.

When the US economy runs payments surpluses with foreign countries, it insists that they pay for their foreign debts and ongoing trade deficits by opening up their markets and “restore balance” by selling their key public infrastructure, industries, mineral rights and commanding heights to US investors. But the US Government has blocked foreign countries from doing the same with the United States. This asymmetry has been a major factor causing the inequality between high US private-sector returns and low foreign official returns on their dollar holdings.

-Michael HudsonAs in all generalized and highly stratified social systems, the richer entities and the poorer entities have become dependent upon one another – the poor on the rich for jobs and money to live, and the rich on the poor to do the grunt work to ensure continued accumulation. The rich also depend on the political weakness of the poor, which gives the rich access to more materials. The poor are trapped by poverty and landlessness. The rich have to constantly extend their power – using the poor as a resource – to protect themselves from fellow capitalists (or nations) in a dog-eat-dog competition. Behind the whole system is an arms race dynamic, as capitalists centers compete to survive.

In the US, which sits at the top of this global pyramid, the necessity to maintain dominance is further complicated by the fact that the US standard of living is based on the constant flow of cheap consumer inputs into the US from abroad, be these oil from Southwest Asia, household products from China, precious metals from Congo, or clothes manufactured in a Latin American maquiladora. Politicians in the US depend on the US population – which is the beneficiary of many of these “unequal exchange” inputs. Politicians cannot remain in office when that consumption level is forced to fall. So US leaders are boxed into the system in such a way that they are obliged to support, defend, and expand neoliberalism.

Neoliberalism, we have seen, is enforced in a variety of ways. It is enforced by dependency on the US dollar. It is enforced by external debt, which must be paid in dollars. It is enforced by sanctions. It is enforced by military means. It is enforced by proxy, using local elites to be the enforcers in their own countries. And it is sometimes, when its back is against the wall, enforced by coups.

Coups, however, have to be disappeared into lies and rationalizations, because the fact of a coup for neoliberalism contradicts the ideological claims of neoliberalism.

On the cover of David Harvey’s book A Brief History of Neoliberalism, there are side by side photos of four people: Ronald Reagan, Margaret Thatcher, Deng Xiaoping, and Augosto Pinochet. These leaders are seen as the instrumental leaders for the development the whole neoliberal project, and together as emblematic of neoliberalism. The complexity of the relationships between them in this process is a subject excluded from this writing. I include it because it reminds us that while the ideology of neoliberalism has placed heavy emphasis on words like freedom, the actual practical development has included very heavy doses of naked authoritarianism.

The Bandaid over this gaping contradiction has been the claim that with economic “liberalization” (a word that conjures feelings of liberation and freedom), political “liberalization” will be its inevitable if eventual offspring. Absolutely nothing in the record, so far, has borne that out.

Harvey defines neoliberalism as “a class project … towards the restoration and consolidation of [ruling] class power.”

Neoliberalism has been an initiative – beginning reactively in the 70s, and becoming self-organized by the time of the Reagan administration in the 80s – designed to shift the weight of social power back to the rich.

It is also a system designed in the United States, for the United States, to perpetuate US global power.

It’s contradiction, according to Harvey, is the contradiction between capital’s need for mobility and the geographic constraints of the state. To smooth over that contradiction, transnational institutions are required to administer a regulatory regime that transcends (though not by any means equally) interstate boundaries. And a transnational military-intelligence-covert operations establishment is required as back-up. With more than a thousand military installations around the world, the US provides the latter.

*

There is push-back from the periphery. Neoliberalism is synonymous with neocolonialism in peripheral-nation streets. Impoverishment leads to destabilization. Destabilization leads to more direct forms of social control – the truncheon and the teargas and the gun.

The US state backs up this global neoliberal regime with military power which can be employed at various places along what the military establishment calls the “spectrum of conflict.” A coup d’etat finds its place somewhere on one end of that spectrum. A coup is a covert civil-military operation.

Sometimes, the colonial surrogates who are in charge need some help. And sometimes, the periphery just needs a reminder of who’s in charge.

Every ten years or so, the U.S. needs to pick some crappy little country and throw it against the wall, just to show the world we mean business.

-Michael Ledeen, holder of the “Freedom Chair” at the American Enterprise Institute.

War is simply a heightened state of current neo-liberal policies of bringing a nation to its knees so as to pry open its resources for Western investment.

-Robert Wrubel

Hot Money Blues

Every day the equivalent of an entire year’s GDP passes through the New York Clearing House and Chicago Mercantile Exchange in payment for trades in stocks and bonds, mortgages and packaged bank loans, forward purchase and repurchase contracts. Most of these trades take about as long as a roulette wheel takes to spin. They are driven neither by psychology nor by industrial technology, but are gambles based on computer-driven programs, or leveraged buyouts of existing assets.

-Michael HudsonWe have a passing acquaintance now with the ideology and practice of neoliberalism. Now we need a basic aerial view of it.

Capital, that is, money that is invested with the hope of a return, can be generally divided into two categories: productive capital and finance capital. Productive capital is investment in making something, an actual product or service. Finance capital is money invested for a royalty. That can be loans to productive capital, but the goal is not whether anything is produced or not; it is whether there will be a return on the investment (ROI) in the form of royalties (for loans, the royalty is interest).

Finance capital can be further subdivided into two poles: investment and speculation.

Productive capital is invested in an actual enterprise that provides a tangible commodity. That can be canned tuna or vacation packages, but the investors know they have to wait for their return until the business turns a profit. The term of art for long-term investment is “slow money.”

Speculation is “playing the markets,” a form of high-end gambling.

The ROI for speculators does not wait for a factory to get built, break even, and begin making money. Speculative capital’s royalties are in strategically buying in and out of fluctuating markets, fast. This is called “hot money.”

With derivatives trading, royalties can be won or lost by making bets on the fluctuations in the markets. “Hot money,” because it can’t be allowed to cool off. Speculators are investing and dis-investing second by second to gain an edge on financial markets, where values can be inflated by the psychology of herd behavior (including stampedes), and by strategic opportunism. It creates vast oceans of fictional value, that is, a lot more flying money than there is material economy to roost on. So far, this always turns out badly.

This applies to the Dutch tulip bubble of 1867. It applies to the global housing bubble of the early 21st Century.

The point is, the development of neoliberalism has privileged finance capital, and it has privileged the speculative pole of finance capitalism. And so the whole project has run into serial crises, more volatile since the introduction of the microchip. In 1997, people with computers in New York plunged East Asia into a deadly economic spiral. Some people have taken to calling this “casino capitalism.”

Walden Bello noted that in 2005 there was $46 trillion in hot-money circulation that year.

Most economic formulas would conclude that trillions of dollars without material assets to back them up might lead to a sell-off of the currency. Think of all the money together as a value of X. Think then of all the commodities available together as Y. If X equals Y, prices are stable. But if X equals 2Y, the prices drop to about half. Too many commodities circulating across against too little money. If 2X equals Y, prices will go up. Too much money circulating against too few commodities, and the purchasing value of each dollar has dropped by half. If you hold dollars, and they exceed the global commodities basket, the dollars should be sold down on currency markets. If not, then the dollars are circulated offline from the material economy… in speculation. This is how bubbles get inflated.

The subject of several books is how the recent and exotic permutations of the betting instruments became the anchor that dragged the entire global economy after it in the 21st Century plunge. But that is only an aside here.

The increase in debt alone should have triggered a dollar-run and terminal stock market crash. The reason it did not is that capitalists around the globe are now completely dependent upon Wall Street’s survival; and they know it. The system had to be internationalized in order to continue to privatize gains (growth) and socialize losses (externalities). Now everyone lives in the dollar economy, and they have to send those dollars (lots of dollars) somewhere to save and invest. That somewhere is the US.

The US is still far and away the largest economy in the world, and size matters.

Not only is the US economy still the largest by far, it also hosts the most important new high-tech arenas of capital accumulation, and leads the world by far in research and development, while American MNCs directly and indirectly account for so large a proportion of world-wide employment, production and trade.

-Leo PanitchThe rest of the world is the bank, and the US owes the bank… a lot. The bank definitely has the problem.

China owns $877.5 billion in US debt, mostly as treasury bills. Japan owns $768.5 billion. UK owns $233.5 billion. Oil exporting nations owns $218.8 billion. Brazil owns $170.8 billion (a good reason Lula de Silva – the former leftist – is adhering to the IMF blueprint). Hong Kong owns $152.4 billion. Taiwan owns $124.1 billion. Russia owns $120.2 billion. Who exactly is going to start the run on the dollar without committing financial suicide?

The world is not yet ready to abandon neoliberalism, nor ready to embrace whatever post-neoliberalism shakes out to be.

Unfortunately, the Obama administration is doing nothing new.

*

‘The One-Trick Pony’ or “Change You Can Believe In’

This treatment of the coup is about what neoliberalism has done to Latin America. That doesn’t mean neoliberalism is only hurting people outside the US. The current grinding crisis in the US is very much “brought to you by Neoliberalism.” There are serious questions now, and not from professional alarmists, about whether a new basis is available to remount as fresh accumulation regime. Neoliberalism is backed into a corner now; the gloves will come off. That is why we are at war, overt and covert, all over the world.

The neoliberal orthodoxy has not been abandoned, even after the 2007 financial blowout in the US. Barack Obama was sworn in as the crisis hit the US like an earthquake; and he summarily re-hired the exact same people who had set the economy up for it, Wall Street neoliberals: Timothy Geithner as Commerce Secretary and Lawrence Summers as Director of the White House Economic Council.

There is a sense of desperation about US policy now, foreign and domestic. Neoliberalism has evolved from transmissible crisis to core-crisis. But the US political-financial establishment has become its own one-trick pony. It just periodically bails out Wall Street when the system sheds value. Everyone else eats the price tag. Obama is bailing out Wall Street (as it has been bailed out six times since Reagan).

Bailouts make Wall Street whole; and coups are an external backstop when people begin to abandon the Washington Consensus. In 2009, Hillary Clinton managed the third US-supported coup in the last eight years. Between April 2002 and June 2009, there were three US-supported coups d’etat. That’s a coup every 28.6 months. This suggests that coups d’etat are still an essential feature of US foreign policy.

The Honduran coup is not the last act in Latin America, however. The outcome of the crisis of neoliberalism is not yet known, and the US has become a weaker (and some would argue, more dangerous) actor.

Resistance to neoliberalism has pushed Latin America further into the hands of more and more “anti-neoliberals.” Iraq and Afghanistan blunted the ability of the US to intervene successfully in the region. The economic crisis that is driving the nail into neoliberalism’s coffin has come home to roost with a terrible and still growing force; and it will be an even greater diversion of energy than the wars, which are still going on and going badly.

The Obama administration will – so long as it has a choice – remain neoliberal, even as we head into an unknown epoch of post-neoliberalism. Michael Lind of Salon wrote:

By the time Barack Obama was inaugurated, the neoliberal capture of the presidential branch of the Democratic Party was complete. Instead of presiding over an administration with diverse economic views, Obama froze out progressives, except for Jared Bernstein in the vice-president’s office, and surrounded himself with neoliberal protégés of Robert Rubin like Larry Summers and Tim Geithner. The fact that Robert Rubin’s son James helped select Obama’s economic team may not be irrelevant.

There is a good reason that the foreign policy establishment of the Obama administration has changed little from the Bush foreign policy establishment (with strong representation from the Reagan era).

Hillary Clinton is a member of the same economic theocracy.

NEXT EPISODE - Cadre and the mechanics of the coup

(Please buy my new book if you're able. Borderline.)

No comments:

Post a Comment